Dell Stock: A Comprehensive Analysis of Performance, Trends, and Future Outlook

Dell stock has been a subject of considerable interest for investors, analysts, and market enthusiasts alike. Understanding the nuances of Dell stock requires a deep dive into its performance history, current market trends, and future prospects. This article aims to provide a comprehensive analysis of Dell stock, offering valuable insights for anyone looking to make informed decisions about investing in or following the company.

Dell’s Performance History

Dell Technologies, a global technology leader, has a rich history that has significantly shaped its current market position. Tracing the journey of Dell stock from its initial public offering (IPO) to its present valuation provides crucial context for understanding its inherent volatility and growth potential.

Initially, Dell focused on direct-to-consumer sales of personal computers. This business model allowed the company to undercut competitors and gain significant market share. As the technology landscape evolved, Dell expanded its offerings to include servers, storage solutions, and networking products. These strategic expansions played a critical role in sustaining Dell’s stock growth over the years.

However, the company faced challenges during the late 2000s and early 2010s, including increased competition and a shift in consumer preferences towards mobile devices. This led to Michael Dell taking the company private in 2013 in a landmark deal, aiming to restructure and revitalize the business away from the public eye.

In 2018, Dell returned to the public market through a complex transaction involving VMware. Since then, Dell stock has experienced fluctuations, influenced by factors such as overall market conditions, technological advancements, and the company’s strategic decisions.

Current Market Trends Affecting Dell

Several key market trends currently impact Dell stock. These trends include the increasing demand for cloud computing solutions, the growing importance of cybersecurity, and the ongoing digital transformation across industries. Dell’s ability to capitalize on these trends is crucial for its future growth and stock performance.

The demand for cloud computing has surged in recent years, driven by the need for scalable and cost-effective IT infrastructure. Dell’s offerings in hybrid cloud solutions and data center infrastructure position it favorably to benefit from this trend. As businesses increasingly adopt cloud-based services, Dell stock could see positive momentum.

Cybersecurity has also become a paramount concern for businesses and governments worldwide. Dell’s cybersecurity solutions, including endpoint security and data protection, are increasingly relevant in today’s threat landscape. The company’s ability to provide comprehensive security solutions could drive demand and positively influence Dell stock.

Digital transformation is another significant trend reshaping industries. Dell’s expertise in providing IT infrastructure, software, and services enables businesses to modernize their operations and enhance their competitiveness. As digital transformation initiatives accelerate, Dell stock stands to benefit from increased demand for its products and services.

Financial Performance and Key Metrics

A thorough analysis of Dell’s financial performance is essential for evaluating the health and potential of Dell stock. Key metrics such as revenue growth, profitability, and cash flow provide valuable insights into the company’s financial strength.

Revenue growth is a critical indicator of a company’s ability to expand its market share and increase sales. Dell’s revenue growth in recent years has been driven by its strong performance in areas such as cloud computing, cybersecurity, and digital transformation. Monitoring revenue trends is essential for assessing the future prospects of Dell stock.

Profitability, measured by metrics such as gross margin and net income, reflects a company’s ability to generate earnings from its operations. Dell’s profitability has been influenced by factors such as pricing pressures, cost management, and product mix. Investors should closely examine Dell’s profitability trends to gauge the sustainability of its earnings.

Cash flow is another important metric that indicates a company’s ability to generate cash from its operations. Dell’s cash flow has been supported by its strong sales and efficient working capital management. Positive cash flow is crucial for funding investments, acquisitions, and shareholder returns, which can positively impact Dell stock.

Factors Influencing Dell Stock Price

Several factors can influence the price of Dell stock. These factors include macroeconomic conditions, industry trends, company-specific events, and investor sentiment. Understanding these influences is crucial for anticipating potential movements in Dell’s stock price.

Macroeconomic conditions, such as economic growth, interest rates, and inflation, can significantly impact stock prices. A strong economy typically leads to increased business spending on IT infrastructure and services, which can benefit Dell stock. Conversely, an economic downturn can negatively affect demand and stock performance.

Industry trends, such as technological advancements and competitive dynamics, also play a crucial role. The rapid pace of innovation in the technology industry requires Dell to continuously adapt and innovate to maintain its competitive edge. Changes in competitive landscape can also affect Dell stock.

Company-specific events, such as earnings announcements, product launches, and strategic acquisitions, can trigger significant movements in Dell stock. Positive news typically leads to an increase in stock price, while negative news can cause a decline. [See also: Dell’s Latest Acquisition Strategy]

Investor sentiment, driven by factors such as market confidence and risk appetite, can also influence Dell stock. Positive sentiment can lead to increased buying pressure and higher stock prices, while negative sentiment can result in selling pressure and lower prices.

Future Outlook for Dell Stock

The future outlook for Dell stock depends on several factors, including the company’s ability to execute its strategic initiatives, capitalize on market opportunities, and manage risks effectively. Analysts’ forecasts and expert opinions provide valuable insights into the potential trajectory of Dell’s stock price.

Dell’s strategic focus on cloud computing, cybersecurity, and digital transformation positions it favorably for future growth. The company’s investments in these areas are expected to drive revenue growth and improve profitability. [See also: Dell’s Cloud Computing Strategy]

However, Dell also faces challenges, such as increasing competition, supply chain disruptions, and macroeconomic uncertainties. The company’s ability to navigate these challenges will be crucial for sustaining its growth and maintaining its stock performance.

Analysts’ forecasts for Dell stock vary, depending on their assumptions about the company’s future performance and the overall market environment. Some analysts are optimistic about Dell’s prospects, citing its strong market position and growth potential. Others are more cautious, citing concerns about competition and macroeconomic risks.

Investment Strategies for Dell Stock

Investors considering Dell stock should carefully consider their investment objectives, risk tolerance, and time horizon. Different investment strategies may be appropriate for different types of investors.

Long-term investors may consider buying and holding Dell stock for the long term, aiming to benefit from the company’s growth potential and dividend payments. This strategy requires a strong belief in Dell’s long-term prospects and a willingness to withstand short-term fluctuations in stock price.

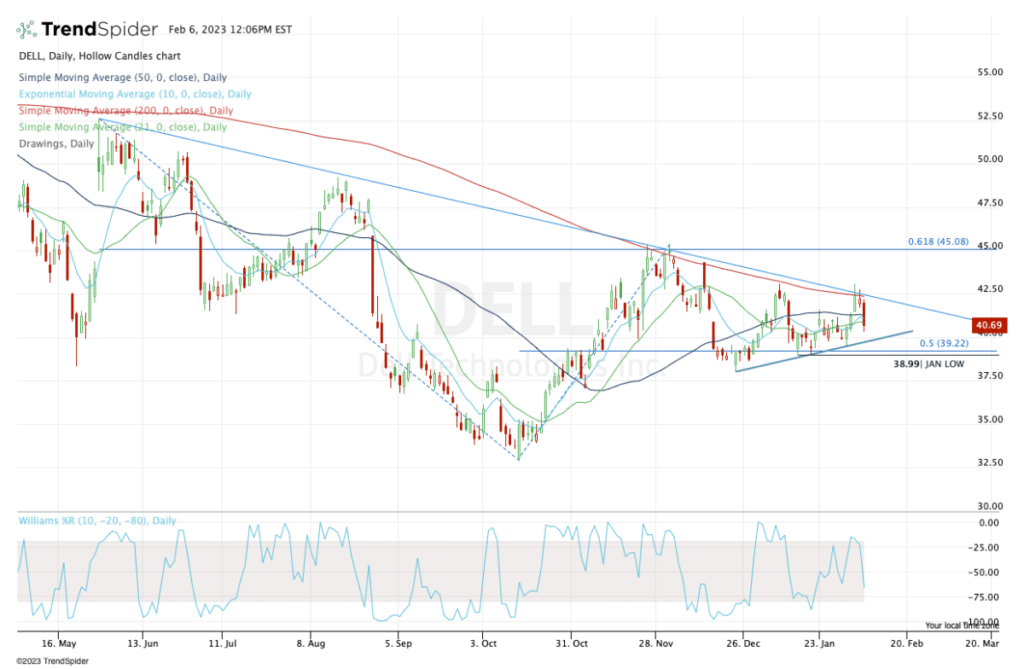

Short-term traders may consider trading Dell stock based on technical analysis and market sentiment. This strategy requires a deep understanding of market dynamics and the ability to react quickly to changing conditions. [See also: Technical Analysis of Dell Stock]

Value investors may consider buying Dell stock when it is undervalued relative to its intrinsic value. This strategy requires a thorough understanding of Dell’s financials and the ability to identify opportunities where the market has mispriced the stock.

Conclusion

Dell stock represents an intriguing investment opportunity in the technology sector. Its performance is influenced by a multitude of factors, including market trends, financial performance, and strategic decisions. By understanding these factors and considering different investment strategies, investors can make informed decisions about Dell stock.

Before making any investment decisions, it is essential to conduct thorough research and consult with a financial advisor. The information provided in this article is for informational purposes only and should not be considered as financial advice.